Investment Opportunity in San Ysidro: A Trust Sale Listing

If you're looking for a new investment opportunity in the real estate industry, you might want to consider San Ysidro, California. This beautiful city is known for its stunning natural landscapes, convenient location, and diverse community. And now, there's a fantastic trust sale investment opportunity that you don't want to miss!Located in the heart of San Ysidro, this listing offers a 4-units plus 1 detach house in the same lot. The listing price is $1,400,000, which is a great deal considering the location and condition of the property. Each unit has been refreshed with new paint, new flooring, updated appliances, new kitchen counters, retextured bathtubs, and new fixtures throughout. It's the perfect opportunity for new renters to settle in and feel at home.This complex is conveniently located near the 805 Freeway shops and close to the International Border. This makes it a prime location for those who commute or travel frequently. It's also an excellent location for those who want to be close to the border and have easy access to Mexico.Investing in San Ysidro is a wise choice due to its growing economy and increasing demand for housing. The city has a diverse population, which means there's always a high demand for rental properties. This makes it an ideal location for investors who want to generate cash flow and build their real estate portfolio.In conclusion, if you're looking for a great investment opportunity in the real estate industry, this trust sale listing in San Ysidro is definitely worth considering. With its prime location, refreshed units, and potential for cash flow, it's an excellent opportunity for savvy real estate investors. Don't let this opportunity pass you by!

Trends 2023: Homeownership creates a rising tide of personal wealth

Financial impact The typical net worth of homeowners is about 40 times greater than that of renters, with home equity often the largest component, according to data in the Federal Reserve’s Survey of Consumer Finances. But the financial benefits go deeper than the numbers alone suggest. Moving into the ranks of homeowners requires planning, saving and prudent management of personal finances that often pays dividends into multiple aspects of personal finance, not just homeownership. These attributes allow owners to accumulate assets and better withstand adverse financial shocks such as a bout of unemployment or large unbudgeted expenses. Moreover, as a homeowner with predictable, and perhaps lower housing costs compared with renting, more income becomes available for saving and investing, helping to boost overall wealth apart from home equity. A study published in 2018 in the Journal of Economic Perspectives, “Homeownership and the American Dream,” shows that owning a home represents a financial investment that outperforms other popular investm ent channels. By analyzing financial data between 2002 and 2016, the researchers found homeowners generally come out ahead taking into account price appreciation and the tax benefits of owning compared with the alternative of renting and investing in the stock market. They used national level data and also data from a number of metro areas with the caveat that the price appreciation of homes varied widely across metro areas over the period studied. For example, based on their analysis, the annual rate of return homeowners realized on their investment in their home outperformed the other investment channels compared for all years from 2004 to 2016 besides one. Even if owning a home tends to lead to a better financial outcome than renting, there are still financial risks inherent in homeownership. The benefits of homeownership for low-income and minority households also have been documented. In a 2013 study presented at Harvard University’s Homeownership Symposium, "Is Homeownership Still an Effective Means of Building Wealth for Low-income and Minority Households? (Was it Ever?)," researchers showed there were, on average, positive and often substantial financial gains for this group of homeowners compared with other households over the period of study, 1999 to 2009, which included the onset of the Gre at Recession and the housing crisis. For example, those who owned homes beginning in 1999 and sustained ownership through 2009, saw household wealth growth grow over 850 percent from 2001 to 2009. The cohort that started homeownership in 1999 but did not sustain ownership (they became renters after owning) saw their wealth decline approximately 9 percent over that same period. Many other factors, of course, contribute to wealth, but this provides a broad, directional impact of homeownership on wealth. https://www.realestatenews.com/2023/01/30/trends-2023-homeownership-creates-a-rising-tide-of-personal-wealth

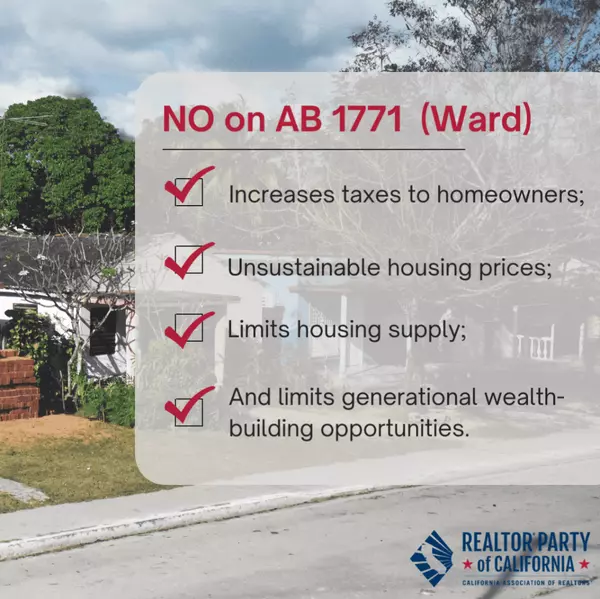

Alert- Oppose New Property Taxes!

SB 1105 grants vast, unchecked, taxing and bonding authority to an unelected Housing Agency Board in San Diego which would consist of 6 appointed representatives, serving 4-year terms that can by resolution, or initiative, impose: special taxes on real property, a parcel tax, a gross receipts business license tax, a special business tax, a documentary transfer tax, a special land value windfall tax, or a commercial linkage fee. The proposed Agency requires revenues generated to assist in the construction of housing broadly defined. Revenue could go to large developers of rental homes and no restrictions on the agency purchasing single-family homes which could then further limit the opportunities for home ownership. The costs of solving California’s housing problems should not be placed on working Californians struggling to stay afloat and keep their homes in a tough economic environment, especially when there is a 97 billion dollar state surplus. Similar to SB 1105, SB 679 would establish a local Housing Agency in LA with a 19-member “governing board” to raise revenues through: a parcel tax gross receipts business license tax a document transfer tax, or the issuance of bonds to fund affordable housing preservation (acquiring, rehabilitating, deed restricting, etc.). Here’s how you can help: Ask your clients, friends, and family to TAKE ACTION and continue posting on social media!We are stronger together, and your voice will help us defeat SB 1105 and SB 679. https://www.housingforcalifornia.com/stop-californias-legislature-from-taxing-families-out-of-homeownership?__hstc=242639005.04270fed11ca6862596d4b08e8eb5867.1649780941642.1659907188442.1659975507821.118&__hssc=242639005.1.1659988491250&__hsfp=3691410742&hsCtaTracking=9aaa8f16-d51f-48c4-9a46-cf58bbed0b26%7Cea564a5a-77eb-46a8-b05a-e90143c2008b

Categories

Recent Posts